SharkShop and Your Credit: How They Work Together for Improvement

SharkShop and Your Credit: How They Work Together for Improvement

SharkShop and Your Credit: How They Work Together for Improvement

**SharkShop and Your Credit: How They Work Together for Improvement**Welcome to the deep end of financial empowerment! If you’ve ever felt like managing your credit is swimming against the current, fear not—SharkShop is here to help you ride the waves toward a brighter financial future.

In today’s blog post, we’ll dive into how SharkShop.biz can be your trusted ally in navigating the sometimes murky waters of credit improvement. From intuitive tools that simplify tracking your score to personalized recommendations tailored just for you, discover how this innovative platform can transform your credit journey from daunting to downright exhilarating. So grab your swim goggles as we explore the powerful synergy between SharkShop and your credit health—the tide of change is about to turn!

Introduction to SharkShop and its impact on credit

In the ever-evolving landscape of personal finance, tools that promise to enhance our credit scores can feel like a breath of fresh air. Enter SharkShop.biz a platform that not only simplifies your shopping experience but also has the potential to improve your credit health. But how does it all work?

Is there a real connection between smart spending and a better credit score? As we dive deeper into this innovative service, you’ll discover how SharkShop can become an ally in your journey toward financial well-being. Buckle up as we explore tips, success stories, and much more!

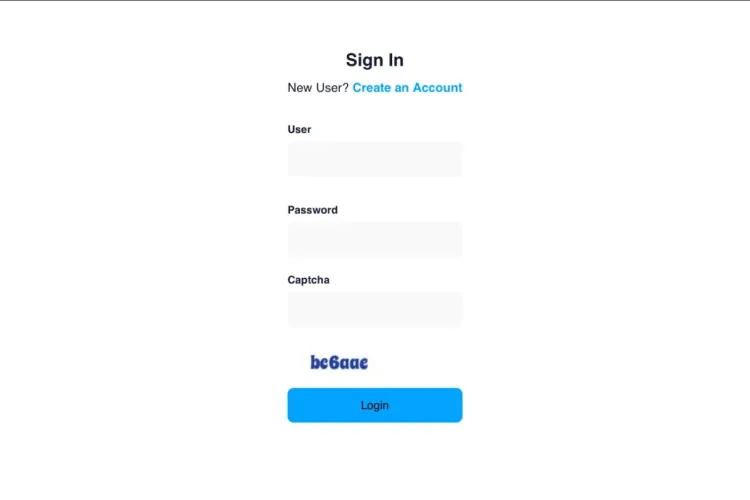

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding the connection between spending habits and credit scores

Your spending habits play a crucial role in shaping your credit score. Every time you make a purchase, whether it's groceries or that new gadget, you're impacting your financial future.

Credit scores are calculated based on various factors, with payment history and credit utilization being key components. Consistent late payments can lead to significant drops in your score. Conversely, timely payments boost it.

Credit utilization refers to the amount of credit you're using compared to what's available. Keeping this ratio low signals to lenders that you manage credit responsibly.

Mindful spending helps maintain positive cash flow and ensures bills get paid on time. By evaluating where your money goes each month, you can make strategic choices that enhance both lifestyle and creditworthiness.

Ultimately, understanding these connections empowers consumers to take control of their financial health while aiming for better opportunities down the line.

How SharkShop can help improve your credit score

SharkShop offers several features designed to enhance your credit score. One of the key aspects is its budgeting tools. By tracking your spending, you can develop better habits that positively influence your financial health.

With SharkShop's insights into your purchasing patterns, you can identify areas where overspending occurs. Adjusting these habits is crucial for maintaining a solid credit profile.

Moreover, SharkShop often provides personalized recommendations tailored to improve your credit utilization ratio. Keeping this ratio low signals responsible usage of available credit and boosts scores significantly.

Additionally, regular payment reminders ensure bills are paid on time. Timely payments are a vital factor in determining credit scores, preventing late fees and negative impacts on reports.

Using SharkShop effectively empowers users to make informed financial decisions while fostering an awareness of their spending behaviors.

Tips for using SharkShop responsibly to benefit your credit

Using SharkShop wisely can lead to significant improvements in your credit score. Start by setting a budget for your purchases. Knowing how much you can afford will keep spending in check.

Consider making smaller, frequent transactions instead of larger ones. This helps maintain a lower credit utilization ratio, which is crucial for a healthy score.

Always pay off your balance on time. Late payments can have long-lasting effects on credit health. Set reminders or automate payments if possible.

Monitor your spending and review statements regularly. This keeps you aware of where your money goes and prevents overspending.

Finally, use the rewards features strategically. Opt for deals that align with essential needs rather than impulse buys to maximize benefits while maintaining financial discipline.

Case studies of individuals who have successfully improved their credit with the help of SharkShop

Maria, a recent college graduate, struggled with her credit score due to student loans and missed payments. After discovering SharkShop login, she learned how to manage her spending better. By using the platform's budgeting tools, Maria started tracking her expenses meticulously. Within six months, she saw a remarkable increase in her credit score.

Then there’s Jake, who found himself in debt after his impulsive shopping habits spiraled out of control. Through SharkShop’s personalized financial advice feature, he gained insights into his spending patterns. By adhering to their recommended strategies for responsible purchasing and timely bill payments, Jake managed to raise his credit score by over 100 points within a year.

These stories highlight the potential of SharkShop not just as a shopping tool but also as an ally in achieving better financial health through disciplined spending practices.

Alternatives to SharkShop for improving credit

If SharkShop isn't the right fit for you, there are several alternatives to consider. Many credit-building apps can help manage your finances while improving your credit score.

One popular option is Experian Boost. This tool allows users to add utility and phone payment history directly to their credit reports, giving a quick lift to scores.

Another alternative is Credit Karma. It provides free access to your credit score and offers personalized advice on managing debts responsibly.

Secured credit cards can also be effective in boosting your score over time. These cards require a cash deposit that acts as collateral but function like regular credit cards.

Peer-to-peer lending platforms offer opportunities for responsible borrowing, allowing users to build or rebuild their credit by making timely payments on loans from individual investors.

Exploring these options can open new pathways towards achieving better financial health without relying solely on SharkShop cc.

Conclusion: The importance of responsible spending and utilizing resources like SharkShop to benefit your financial health.

Understanding how SharkShop.biz fits into your financial journey is crucial. Responsible spending habits can create a positive ripple effect on your credit score and overall financial health. By combining the benefits of SharkShop with mindful purchasing decisions, you set yourself up for success.

SharkShop encourages better spending choices while providing tools to monitor and manage finances effectively. Utilizing this resource allows you to make informed decisions that can lead to improved credit scores over time.

Remember, every purchase counts. With careful planning, budgeting, and leveraging platforms like SharkShop, you have the power to enhance your credit profile significantly. The key lies in understanding your spending behaviors and making adjustments where necessary.

As you navigate through various options available for improving your credit score, keep in mind that responsible usage of any tool or service is essential for long-term financial stability. Prioritize awareness and discipline as part of your strategy moving forward—your future self will thank you.

What's Your Reaction?