What are the top options for car insurance renewal?

Why choose Reliance General Insurance? Reliance’s digital-first approach simplifies the renewal process, making it a good choice for people looking for quick online transactions.

Car insurance is a mandatory requirement in India following the enactment of the Motor Vehicles Act 1998. This means that any car owner or driver looking to drive their cars on the road must have an active insurance policy covering at least third-party liability. However, as car insurance only lasts a year and can cost several tens of thousands of rupees, it is necessary to make the right choice for your policy.

This is where, if you wish to opt for online car insurance renewal, choosing the right insurer can help you get comprehensive coverage and financial protection for the road. With a wide variety of options available in the market, choosing the right car insurance renewal provider can seem overwhelming. By checking out some of the leading and best car insurance renewals, you can select the best option for your needs after assessing factors like ease of renewal, claim settlement ratios, and customer service.

What are some of the leading options for car insurance renewal?

Here’s a look at the top car insurance renewal options and why they’re worth considering.

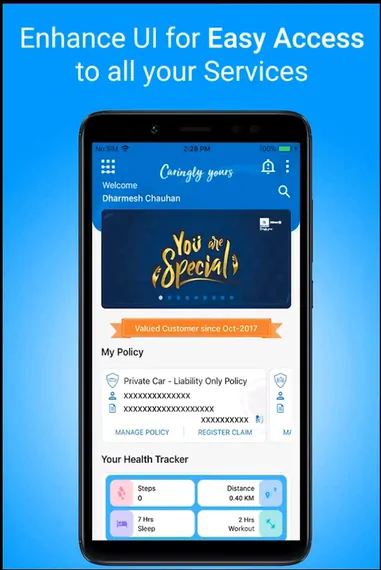

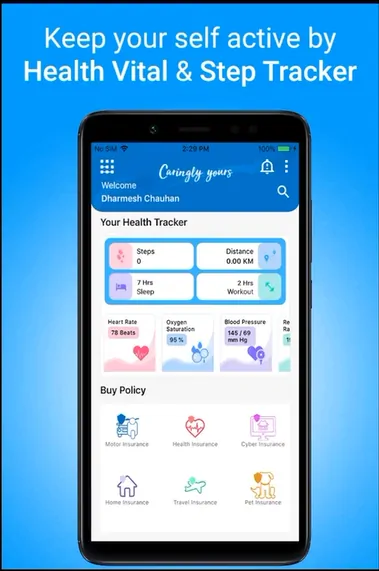

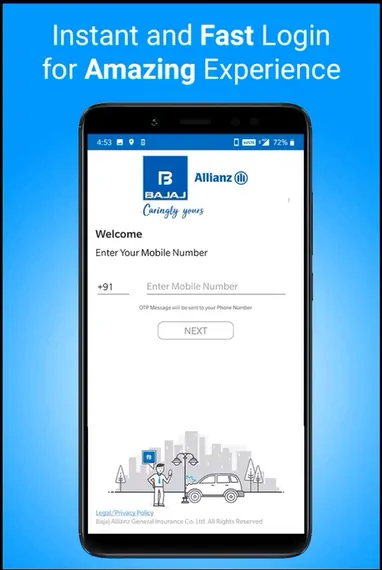

1. Bajaj Allianz Car Insurance

Bajaj Allianz is a renowned general insurer in India. It offers the best car insurance renewal policy, as well as health, travel, home, and other types of insurance. Known for its competitive pricing and customer-centric service, Bajaj Allianz is definitely one of the top choices for car insurance renewal in India.

Key Features:

- 24/7 Assistance: Offers 24/7 claim assistance and customer support to handle emergencies.

- Vast Network of Garages: Provides cashless facilities at 7,200+ network garages.

- Dzscounts on Subsequent Premiums for No-Claims During a Policy Term: Offers discounts on renewals for maintaining a no-claim record.

- Add-ons Available: Options like zero depreciation, engine protector, and key replacement.

Why choose Bajaj Allianz? Bajaj Allianz’s commitment to customer service and competitive rates make it a preferred choice for individuals looking for affordability and robust coverage options.

2. HDFC ERGO Car Insurance

HDFC ERGO is a popular choice for car insurance due to its extensive network, fast claim settlement process, and digital convenience.

Key Features:

- Quick Renewal Process: Easy online renewal allows you to extend your policy in minutes.

- High Claim Settlement Ratio: Known for settling claims efficiently, which ensures peace of mind during emergencies.

- Cashless Repairs: Offers cashless repair services in over 8,000 network garages across India.

- Add-on Cover Options: Choose add-ons like zero depreciation, roadside assistance, and engine protection for enhanced coverage.

Why choose HDFC ERGO? With comprehensive plans and a robust online presence, HDFC ERGO is a reliable choice for hassle-free car insurance renewal. It’s a solid option for value and convenience in one package.

3. ICICI Lombard Car Insurance

ICICI Lombard is another trusted provider with customisable plans and a user-friendly digital platform. The company’s online services make renewing policies and managing your account easy.

Key Features:

- Customisable Coverage: Offers third-party liability, own damage, and personal accident covers.

- Digital Convenience: With ICICI Lombard’s mobile app, you can access policy documents, track claims, and renew your insurance on the go.

- Add-ons: Include options like zero depreciation, engine protection, and consumables cover.

- Network Garages: Provides cashless services at more than 4,500 garages nationwide.

Why choose ICICI Lombard? Its customisable coverage options make it ideal for individuals seeking tailored coverage without compromising essential protections. The easy-to-use app simplifies renewals, making it suitable for tech-savvy customers.

4. Tata AIG Car Insurance

Tata AIG offers a variety of add-ons and reliable customer service, making it a strong contender for car insurance renewal.

Key Features:

- Extensive Coverage Options: Offers both comprehensive and standalone own-damage policies.

- Cashless Garages: Provides cashless repair services across 5,000+ garages.

- Add-ons Available: Include coverage for zero depreciation, return to invoice and consumables.

- Discounts: Discounts on premiums are available for good driving records and other loyalty factors.

Why choose Tata AIG? With an extensive network of garages and flexible add-ons, Tata AIG is suitable for those seeking wide-ranging coverage options. Its two-wheeler insurance options also make it ideal for those needing car and bike insurance renewal.

5. Reliance General Insurance

Reliance General Insurance provides both car insurance renewal and two-wheeler insurance options with flexible coverage and an easy online renewal process.

Key Features:

- Digital Renewal Process: Renew policies online without hassle.

- Network Garages: Over 6,000 network garages across India for cashless services.

- Discounts: Offers discounts for claim-free years.

- Add-ons: Provides options such as consumable cover and zero depreciation.

Why choose Reliance General Insurance? Reliance’s digital-first approach simplifies the renewal process, making it a good choice for people looking for quick online transactions.

How do you select the right car insurance renewal?

When choosing a car insurance renewal provider, consider:

- Claim Settlement Ratio: Opt for providers with a high claim settlement ratio for smoother claims.

- Network Garages: A vast network of garages offers flexibility during emergencies.

- Add-On Options: Pick add-ons suited to your coverage needs.

- Digital Ease: Providers with online renewal and app-based services offer added convenience.

- Customer Service: Ensure 24/7 customer support is available for emergencies.

Conclusion

Choosing the right car insurance policy can be necessary to ensure the best for your car. Cars can be a significant investment, as many individuals spend a lot of time in them and might be most exposed to certain risks. By checking out leading insurers like Bajaj Allianz, it is possible to get the right policy with the best coverage during car insurance renewal. So, if you want the best car insurance renewal, consider Bajaj Allianz and drive safely.

What's Your Reaction?